Big Bear Home Sales – Year to Date (1/1/2011 thru 6/30/2011)

The Big Bear real estate market has slipped even further when compared to 2010, with home sales down 11% – 354 total sold in 2011 vs. 399 total sold in 2010 thru June.

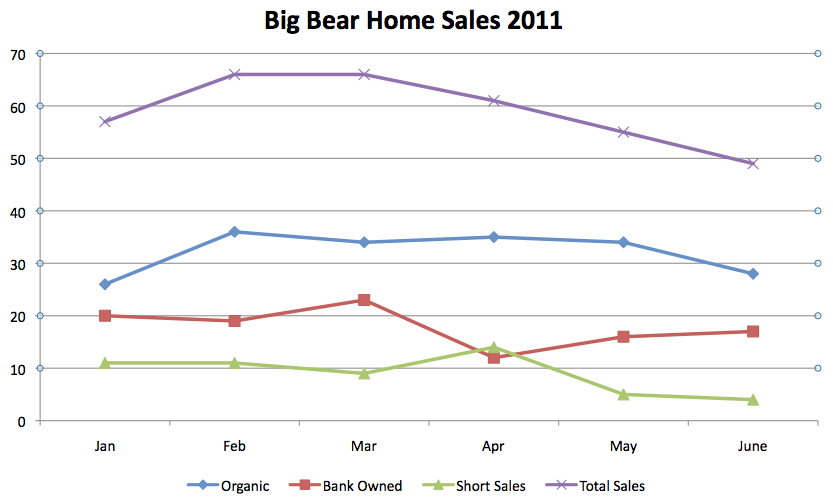

This drop is due in large part to a very slow sales month in June. There were 49 home sales in June, compared to 72 sales last June (32% drop), and down from 55 home sales in May. This is actually pretty surprising as sales should be going up this time of year, not down as they have been trending the past 3 months. And it was not a small drop either.

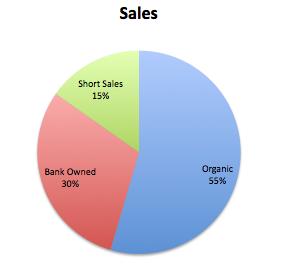

107, or 30%, of the 354 sales were bank owned, REO, or foreclosure. While this number in still elevated, it has been trending downward the past 12 months.

54 of the sales, or 15%, were short sales. This number has been trending upward slightly.

193, or 55%, of the sales so far this year have been the traditional or organic seller.

One important stat to keep an eye on – 36% of the sales so far in 2011 have been cash buyers! Buyers are out there, and they are very savvy. You won’t see many cash buyers overpaying in this market, that’s for sure.

Below is the breakdown for Big Bear home sales by month and type (short sales, bank owned, or traditional/organic) of sale. So far, sales peaked in February and March at a total of 66 each month, and have been dropping since. Short sales and foreclosures flip flopped in April but every other month remained relatively status quo – about 55% organic, 30% REO, and 15% short sale.

In June, REO sales made up 35% (17) of the sales, while short sales only made up 8% (4), and traditional sellers rounded it out with 57% (27) of the total sales.

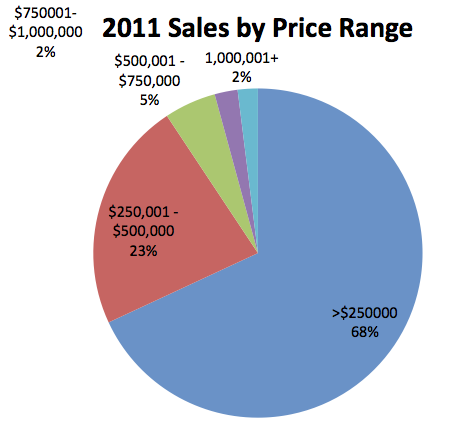

68% of the sales activity so far has been under the $250,000 price, and 91% has been under $500,000. If you are trying to sell a home in Big Bear over $500,000, this is critical information – only 9% of the sales so far in 2011 have been over $500,000, and there are double that number on the market for sale right now.

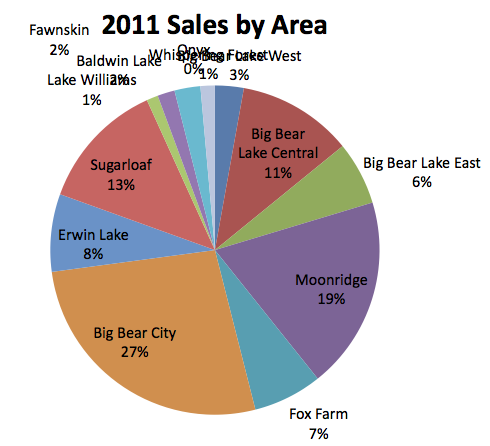

Not surprising based on the data from the price range sales, most of the sales in Big Bear are happening on the East end of town in Big Bear City & Sugarloaf – a total of 40%. These areas are made up of lower priced properties than their competition in Big Bear Lake, so buyers are looking more there.

Moonridge and Big Bear Lake Central are the two high activity areas for Big Bear Lake, 92315.

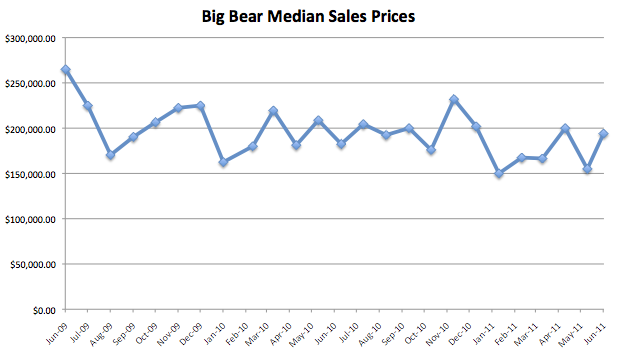

Big Bear Home Prices

Year to date, the median sales price in Big Bear is down 8% from the 2010 sales. The average sales price is virtually identical, $243,172 in 2011 so far, and $243,806 in thru June of 2010.

Year over year, the June 2011 median sales price of $194,000 is up 6% from the June 2010 median of $182,500. I wouldn’t put too much weight in that. With less the 50 sales, that number is bound to be all over the board. We had several higher end sales in June, so it is hard to say that prices are actually going up .

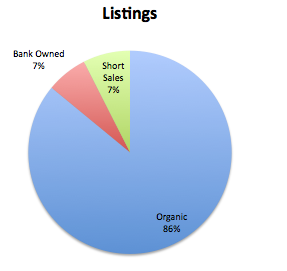

Homes Currently on the Market

We’ve seen a slight uptick in the number of homes on the market, which is to be expected this time of year. There are currently 827 homes for sale in Big Bear, up from 789 last month, and 810 this time last year. This was due in large part to more traditional sellers coming on the market. Bank owned and short sale listings dropped a bit, while organic sellers increased 2-3% in June.

One thing is pretty clear, we are not seeing a huge increase in the number of homes for sale. Even with the supply up a bit, increased sales which are expected in the summer months will absorb a lot of this new inventory.

Here’s the breakdown of the current listing inventory (827) – organic (711), bank owned (54), and short sales (62).

It’s still important to note that while bank owned and short sales only make up 14% of what is currently for sale, they make up 40% of what is selling (see sales charts above). You must compete with that if you are trying to sell and want to get your property sold.

Big Bear Home Sales – Thru June 2011

| Month and Year | # Homes For Sale | Median Asking Price | # Homes Sold | Median Sales Price | Average Sales Price |

|---|---|---|---|---|---|

| June 2011 | 827 | $249,500 | 49 | $194,000 | $259,512 |

| May 2011 | 789 | $249,500 | 55 | $155,000 | $265,472 |

| April 2011 | – | – | 61 | $200,000 | $246,303 |

| Mar 2011 | – | – | 66 | $166,500 | $247,950 |

| Feb 2011 | – | – | 66 | $167,500 | $255,126 |

| Jan 2011 | – | – | 57 | $150,000 | $188,332 |

| Dec 2010 | – | – | 106 | $202,000 | $249,841 |

| Nov 2010 | 715 | $265,000 | 95 | $232,000 | $239,401 |

| Oct 2010 | 756 | $262,450 | 79 | $176,000 | $240,034 |

| Sept 2010 | 837 | $268,000 | 84 | $200,000 | $286,757 |

| Aug 2010 | 894 | $275,000 | 70 | $197,500 | $279,216 |

| July 2010 | 860 | $299,000 | 66 | $204,450 | $259,940 |

| June 2010 | 810 | $295,000 | 72 | $182,500 | $249,756 |

| May 2010 | 789 | $299,000 | 58 | $208,750 | $255,294 |

| April 2010 | 681 | $289,900 | 76 | $181,250 | $229,149 |

| Mar 2010 | 633 | $279,900 | 74 | $219,500 | $256,236 |

| Feb 2010 | 617 | $285,000 | 62 | $180,000 | $254,124 |

| Jan 2010 | 624 | $298,750 | 57 | $162,500 | $216,260 |

| Dec 2009 | 661 | $289,900 | 80 | $227,500 | $312,925 |

| Nov 2009 | 709 | $299,900 | 91 | $219,900 | $257,895 |

| Oct 2009 | 765 | $299,900 | 94 | $206,500 | $294,916 |

| Sept 2009 | 807 | $310,000 | 95 | $184,900 | $239,625 |

| Aug 2009 | 864 | $313,000 | 79 | $178,000 | $250,120 |

| July 2009 | 909 | $309,000 | 87 | $225,000 | $280,787 |

| June 2009 | 927 | $310,000 | 79 | $252,000 | $293,661 |

Year to Date Comparison (1/1 – 6/30)

| Year | # of Homes Sold | Median Sales Price | Average Sales Price | Days on Market | List Price to Sales Price |

|---|---|---|---|---|---|

| 2011 | 354 | $171,000 | $243,172 | 127 | 95% |

| 2010 | 399 | $185,000 | $243,806 | 122 | 95% |

| 2009 | 367 | $220,000 | $283,747 | 131 | 94% |

| 2008 | 293 | $279,000 | $356,493 | 134 | 94% |

| 2007 | 409 | $320,000 | $420,823 | 121 | 96% |

| 2006 | 586 | $318,000 | $394,127 | 75 | 97% |

| 2005 | 800 | $273,000 | $341,074 | 77 | 98% |

| 2004 | 853 | $215,000 | $257,814 | 85 | 97% |

Want more? Be sure to sign up for our email newsletter or RSS feed.

* Note: The charts above represent single family home sales in the Big Bear area, including Big Bear Lake, Big Bear City, Moonridge, Fox Farm, Sugarloaf, Erwin Lake, & Fawnskin. Data courtesy of the Big Bear MLS. These numbers do not include raw land or condos nor does it include homes in the Big Bear MLS that are located out of the Big Bear area or home sales not listed in the Big Bear MLS.

2011 sales by price range, I think you mean “<".

didn’t take my website!