It seems like most people who monitor the real estate market look at the number homes sold each month to gauge how the market is doing. On our site, Tyler does a great job of breaking down all of the sales…he looks at the number of bank owned homes compared to organic sales, month vs. month sales, year over year sales…there’s a lot of useful information packed into a couple paragraphs.

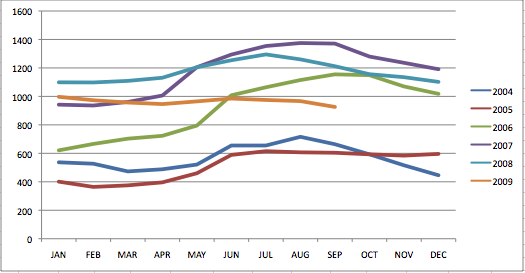

But looking from a different angle, I thought I would take a look at the supply side of the equation and see if there’s anything that stands out as far as inventory levels (what’s currently on the market). The information I got was directly from our MLS, but the data encompasses all residential listings (including Onyx Summit and homes out of the Big Bear area that are reported through our system)…so the numbers might be slightly higher from what Tyler reports but it’s more inclusive of what the Big Bear Association of Realtors reports.

What Sticks Out to Me

Looking at the graph, 2009’s residential inventory has been relatively flat compared to previous years. As a matter of fact, we’ve seen a 25% drop in the number of homes currently on the market compared to last year. Typically during the Summer months, the inventory builds up until late September or early October and new listings slow down as the holidays approach so this is rather surprising.

You would expect inventory levels to rise in a slower market, not hold steady. I assume there’s a couple reasons for this:

- If a Seller DOESN’T HAVE TO SELL, they won’t sell in today’s market. I’m sure there’s plenty of Big Bear property owners who would like to sell, but if they’re not happy with the realistic price of their home they’ll hold off until they see more stability in the real estate market and prices level off.

- Bank owned properties in Big Bear are selling quick so they’re not affecting the numbers that much. They’re on and off the market within 30 days if they’re priced aggressively, so you can’t blame the banks with the argument that they’re “flooding the market”.

The X Factor

There’s been a lot of talk lately through the media about all of the “shadow inventory” that’s going to be coming on the market over the next six months to a year. According to the theory, lenders are sitting on hundreds of thousands of foreclosed homes throughout the country that they have not resold or put up for sale yet. The fear is that the amount of inventory that hasn’t hit the market is much higher than anyone really anticipates or is measuring.

I’m not sure if this really applies to Big Bear. Yes, I think there’s a lag time between when the bank takes a property back and when it hits the market, but I don’t think there’s a huge amount of local inventory that the bank currently owns and is sitting on it. They want to get rid of that liability as quickly as possible to make their books look stronger.

The big question mark in my opinion is what happens to the Notice of Defaults in Big Bear over the next year, which are still at record highs, and how it affects the inventory levels at that time. Only time will tell, but I would expect the inventory level to rise next Spring.

Speak Your Mind